The Deputy Speaker, Thomas Tayebwa directed the Attorney General to present an update to the House on the progress of a proposed Consumer Protection law.

This followed concerns by some legislators over the manner in which financial institutions like banks place high insurance charges on loans taken by their clients.

According to Hon. Aisha Kabanda (NUP, Butambala District Woman Representative), some banking institutions charge double insurance on top-up loans taken by individuals.

“If you are left with a balance on a loan of Shs40 million and you want to top-up to Shs100 million and they are only going to give you Shs60 million, they charge insurance on the whole amount of the loan, which is double charging. This is cheating people,” said Kabanda.

She raised the concern during the plenary sitting on Tuesday, 04 February 2025.

Kabanda called on government, through the Ministry of Finance, Planning and Economic Development to put in place, regulations to guide banks on such charges.

The Minister for Finance, Planning and Economic (General Duties), Hon. Henry Musasizi, however, said it is a matter that should be handled between commercial banks and their clients.

“We [Ministry of Finance] do not negotiate on behalf of the clients. If a loan is not favourable, do not take it,” Musasizi said.

Otuke County MP, Hon. Paul Omara reiterated the minister’s position saying that loan agreements are a product arrangement between an individual and the bank, adding that Bank of Uganda and the Ministry of Finance have nothing to do with it.

“Bank of Uganda ensures that by regulation, all banks must display all their charges to the public so that people can see and understand them. If you choose to take a particular product, it would have been believed that you have taken it from a point of knowledge,” he added.

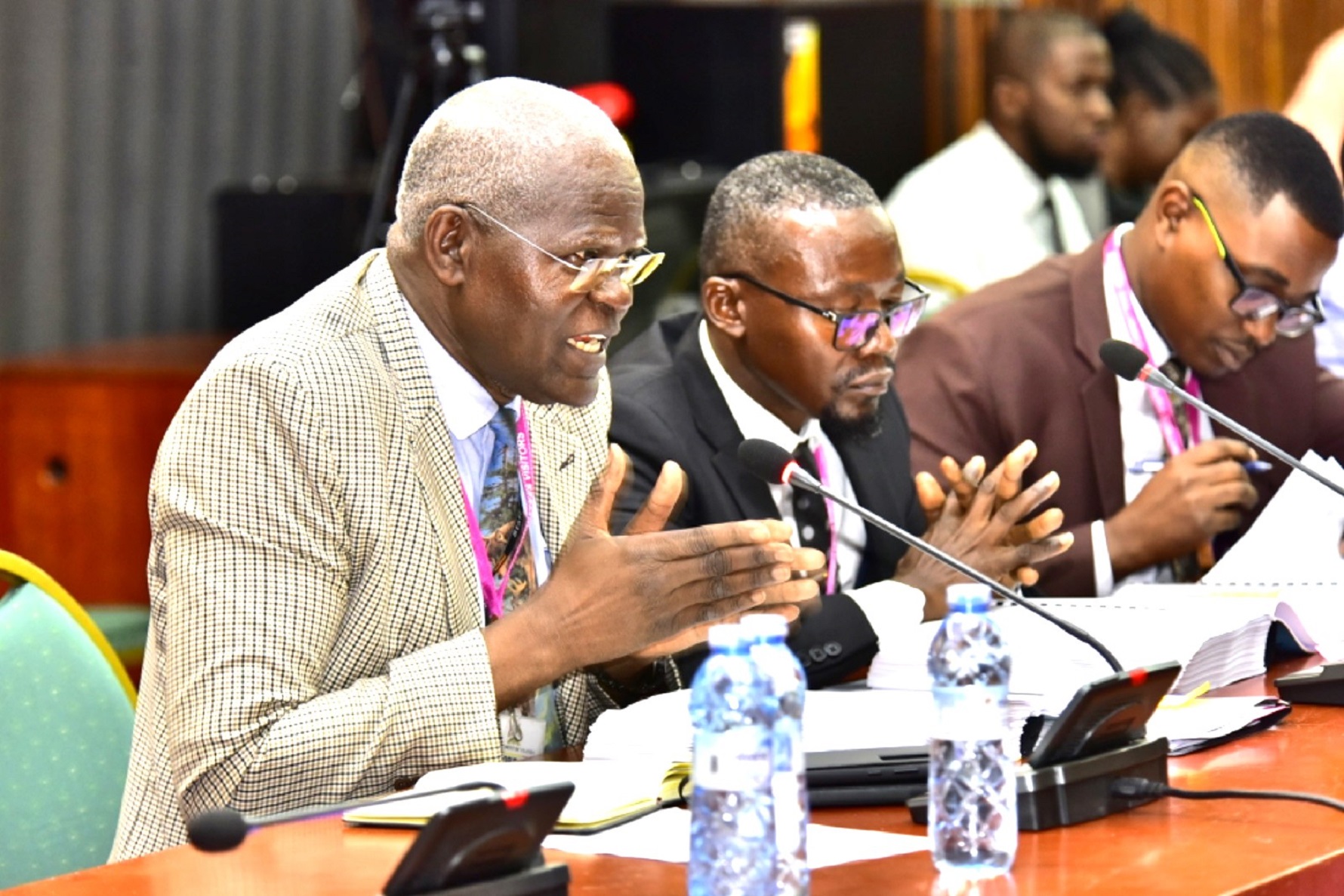

Hon. Medard Sseggona (NUP, Busiro County East) however, challenged the two positions saying the Ministry of Finance ought to take interest in the manner in which the said exorbitant charges are made.

“Banking practice is also regulated by law and supervised by Bank of Uganda. This raises two issues of law and consumer protection. If I were in the minister’s shoes, I would commit to carrying out investigations and then report,” said Sseggona.

He added that there is need for regulations that will regulate the practice, noting that lack of consumer protection has made the economy lag behind.

“The credit facilities in this country remain very expensive and these are areas which the Ministry of Finance needs to look into. When the minister shakes his head in disagreement, I get worried that he is not about to protect Ugandans. I would implore him to first to seek to know, then come and give us an informed answer,” Sseggona added.

The Deputy Speaker tasked the Minister for Finance to investigate the matter and present a report to Parliament within two weeks.