The Uganda Revenue Authority (URA) registered a 13 per cent growth in Value Added Tax (VAT) in the year ended 30 June 2023.

This is contained in a report of the Public Accounts Committee on Commissions Statutory Authorities and State Enterprises (COSASE) which observed that the growth was largely driven by local production of goods and services that attract VAT.

The sugar production registered a surplus of Shs7.79 billion which was attributed to timely enforcement of the Electronic Fiscal Receipting and Invoice Solutions (EFRIS).

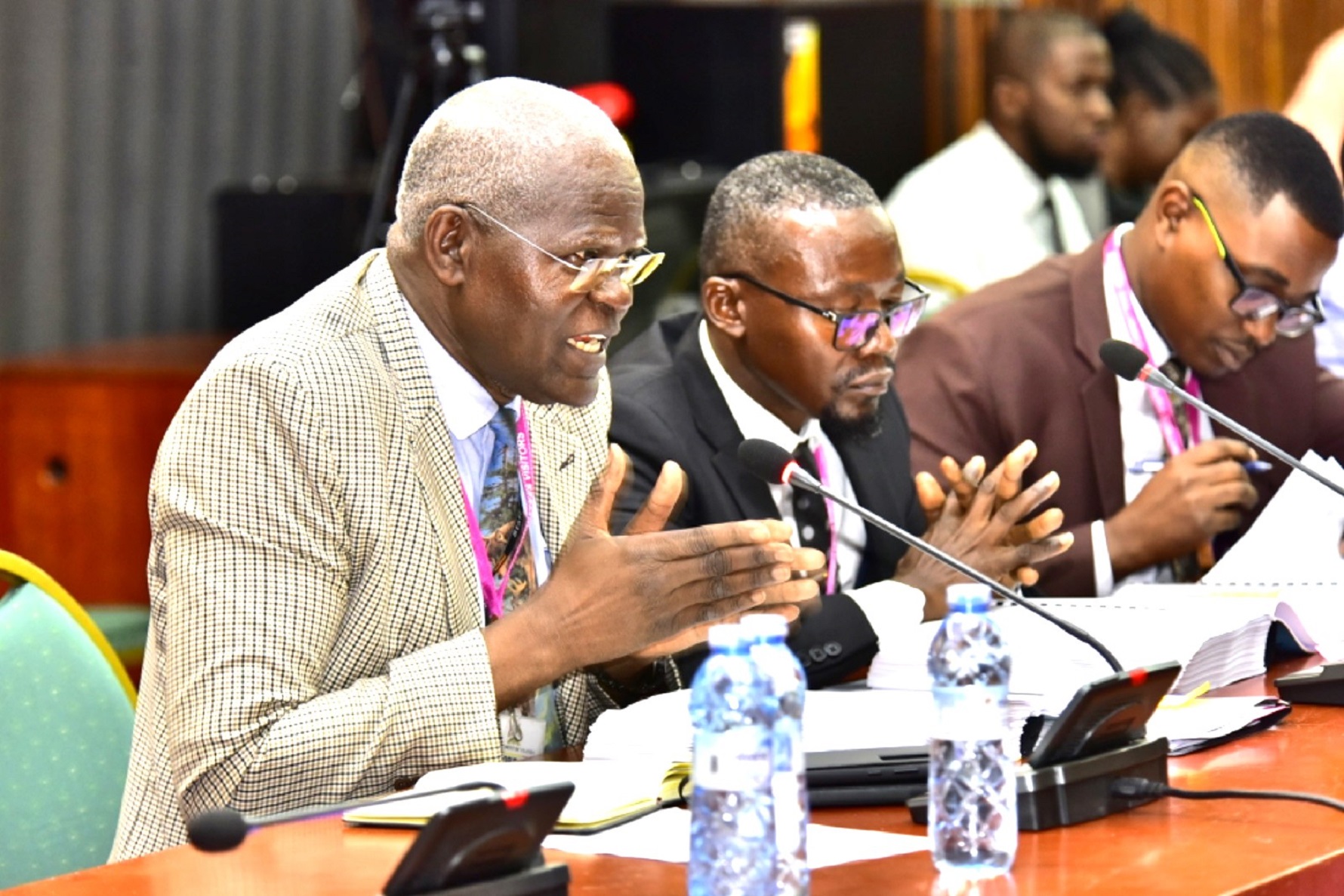

The Chairperson of the committee, Hon. Medard Lubega Sseggona presented the report during on Tuesday, 01October 2024.

“The committee recommends enforcement of EFRIS to all eligible tax payers to increase tax revenue collections. URA should roll out EFRIS after extensive and comprehensive sensitisation of tax payers,” Sseggona said.

The report observed that the roll out of EFRIS was overdue noting that the registration of tax payers onto the system is envisaged to have ended by June 2014 and rolled out in July 2024.

“The accounting officer should fast track completion of the system to ensure the seamless functioning of the EFRIS and enhance tax administration efficiencies,” read the report in part.

According to the committee, inadequate tax payer education amongst the population had resulted into apathy and resistance against the new VAT tax collection modality.

“Management of URA should invest in tax payer education to increase tax compliance and improved revenue collection which was the objective of introducing EFRIS,” Sseggona said.

Arua District Woman Representative, Hon. Lillian Paparu proposed involvement of local leaders in tax payer education blaming the misunderstandings between URA officials and local business communities to low involvement of local leaders.

“Let local leaders be involved and tax education enhanced so that there is a good relationship between URA and the community,” she said.

In a related development, the committee also presented a report on the Uganda Wildlife Authority (UWA) and faulted the organisation for not following accounting and expenditure procedures.

Sseggona said that UWA spent Shs4.7 billion above its approved budget which he said is tantamount to fraud.

According to the report, the wildlife regulator was found to have unaccounted for expenditure of over Shs462 million.

“For expenditure amounting to Shs198 million there were no supporting documents while payment vouchers for Shs264 million were missing. As a result, the Auditor General was unable to confirm whether the funds in question totaling to Shs462 million were spent for the intended purposes,” Sseggona said.

MPs recommended that entities with weak internal accounting mechanisms should be compelled to submit their non-tax revenue collections to the Consolidated Fund to avoid the likelihood of fraud.

“We are seeing leakages in revenue spent at the source from several COSASE reports. In one report, when Uganda Revenue Authority took over the revenue collections, the non-tax revenue increased,” said Hon. Fredrick Angura (NRM, Tororo South County).